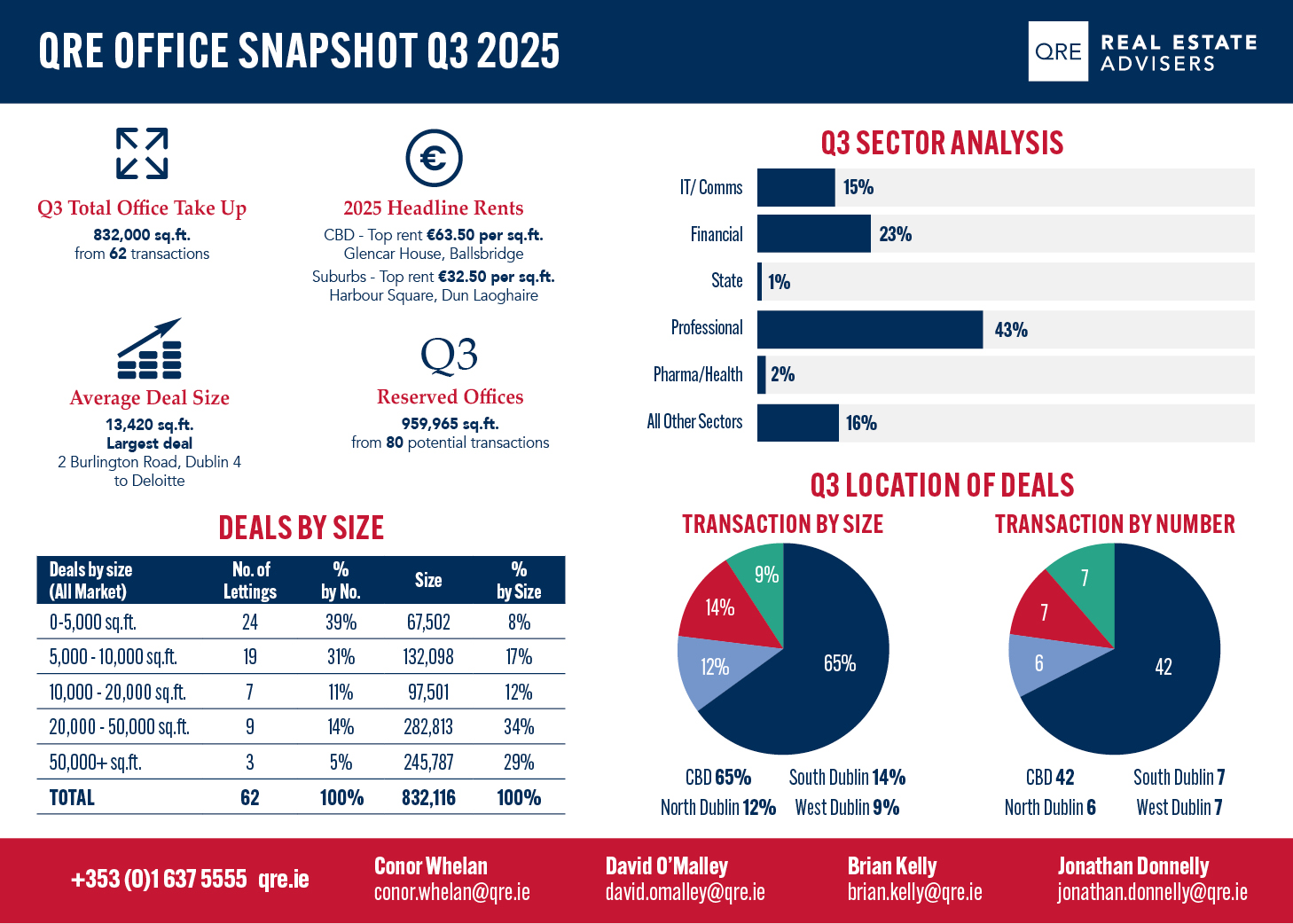

Q3 2025 marked a strong quarter for the Dublin office market, with total take-up reaching approximately 832,000 sq. ft., representing a 39% increase on Q3 2024. This positive momentum was mirrored in deal activity, with 62 transactions completed, up from 34 in the previous quarter.

While the average deal size decreased from 19,540 sq. ft. in Q2 to 13,420 sq. ft. in Q3, this was primarily due to the absence of larger scale one off transactions such as Workday’s College Square deal, which notably influenced Q2 figures.

The standout transactions of the quarter included Deloitte’s 87,000 sq. ft. lease at 2 Burlington Road Dublin 4, Air Lingus’ take up of 81,000 sq.ft. in 1 Dublin Airport Central Dublin 9 and AIB’s 77,000 sq.ft. in Block B Central Park Dublin 18.

The professional services, financial services, and technology sectors remain the core drivers of activity in the Dublin office market, with a consistent focus on centrally located, sustainable buildings that align with corporate ESG commitments and support talent attraction and retention strategies.

In Q3 2025, sustainability continued to drive activity in the Dublin office market, with 37 of the 62 transactions completed in buildings holding a BER rating of B3 or higher.

The average deal size among the higher rated category reached approximately 14,700 sq. ft., highlighting corporate occupiers’ growing focus on energy efficiency and a clear preference for best in class, sustainable offices.

The remaining 18 deals were in buildings with a BER of C or lower, accounting for 288,000 sq.ft. (35% of total take-up), with an average deal size of approx. 11,500 sq.ft. This highlights how smaller SME occupiers remain primarily driven by location and value, rather than ESG performance.