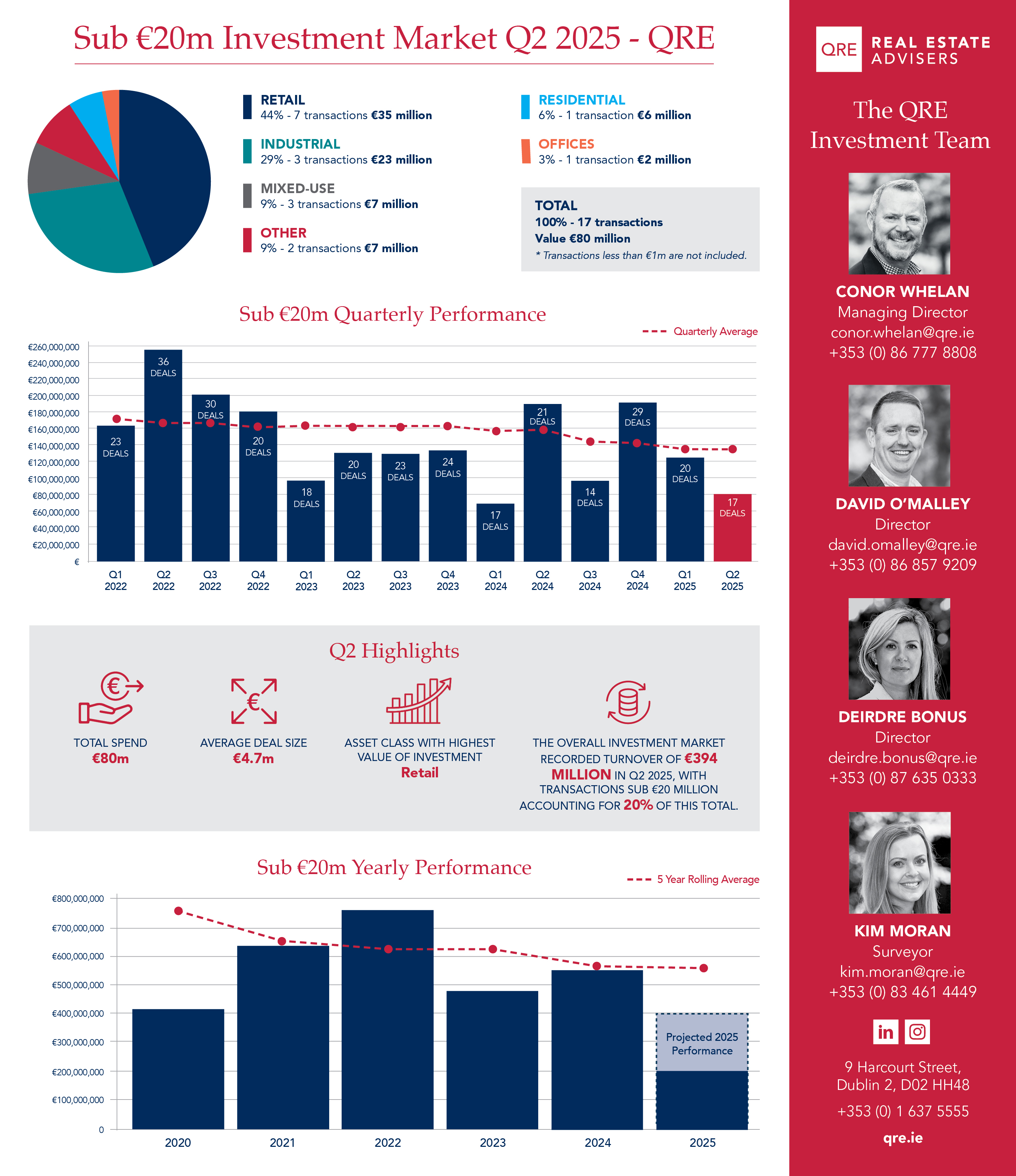

The sub-€20 million market accounted for €80 million of turnover in Q2, representing 20% of overall investment activity for the quarter.

Retail remained the standout performer, accounting for 44% of total spend, while the average deal size held steady at €4.7 million across 17 transactions. Despite a slower pace of activity, consistent investor appetite in this sector continues to drive liquidity - particularly for assets offering higher-yielding, stable income profiles with strong lease fundamentals.

As market conditions continue to evolve, we expect activity in the sub-€20 million market to remain steady through the second half of the year, particularly as pricing expectations adjust and new opportunities emerge in a market that continues to be affected by ongoing geopolitical activity.

Sub-€20 Million Investment Market Q2 2025

Sub-€20 Million Investment Market

QRE Snapshot

written by Kim Moran

July 2025

Featured News & Blogs

- Corballis Hall secures tenant for penthouse offices

- Office Snapshot Q3 2025

- Q3 2025 Investment Statistics